Whale Strategy Full Report (20200101 - 20250701)

免责申明

本内容仅供参考,市场行情波动巨大。请根据自身情况合理操作,作者不承担由此产生的任何损失。

📊 Strategy Overview

This report is produced by https://www.itrade.icu Quantitative Trading Lab.

We used real market data combined with a quant backtesting engine to conduct a continuous 5 years and 7 months backtest and live trading test on the Whale Strategy, achieving impressive results.

Lookahead Bias Test

The strategy underwent Lookahead Bias Analysis, and the results show:

has_bias: No → No lookahead biasbiased_entry_signals: 0 → No biased entry signalsbiased_exit_signals: 0 → No biased exit signalsbiased_indicators: None → No biased indicators

This means the strategy did not use future data during backtesting, so results are not artificially inflated.

Lookahead Analysis

┏━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━┳━━━━━━━━━━┳━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━┓

┃ filename ┃ strategy ┃ has_bias ┃ total_signals ┃ biased_entry_signals ┃ biased_exit_signals ┃ biased_indicators ┃

┡━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━╇━━━━━━━━━━╇━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━┩

│ WhaleStrategyV1.py │ WhaleStrategyV1 │ No │ 20 │ 0 │ 0 │ │

└────────────────────┴─────────────────┴──────────┴───────────────┴──────────────────────┴─────────────────────┴───────────────────┘2

3

4

5

6

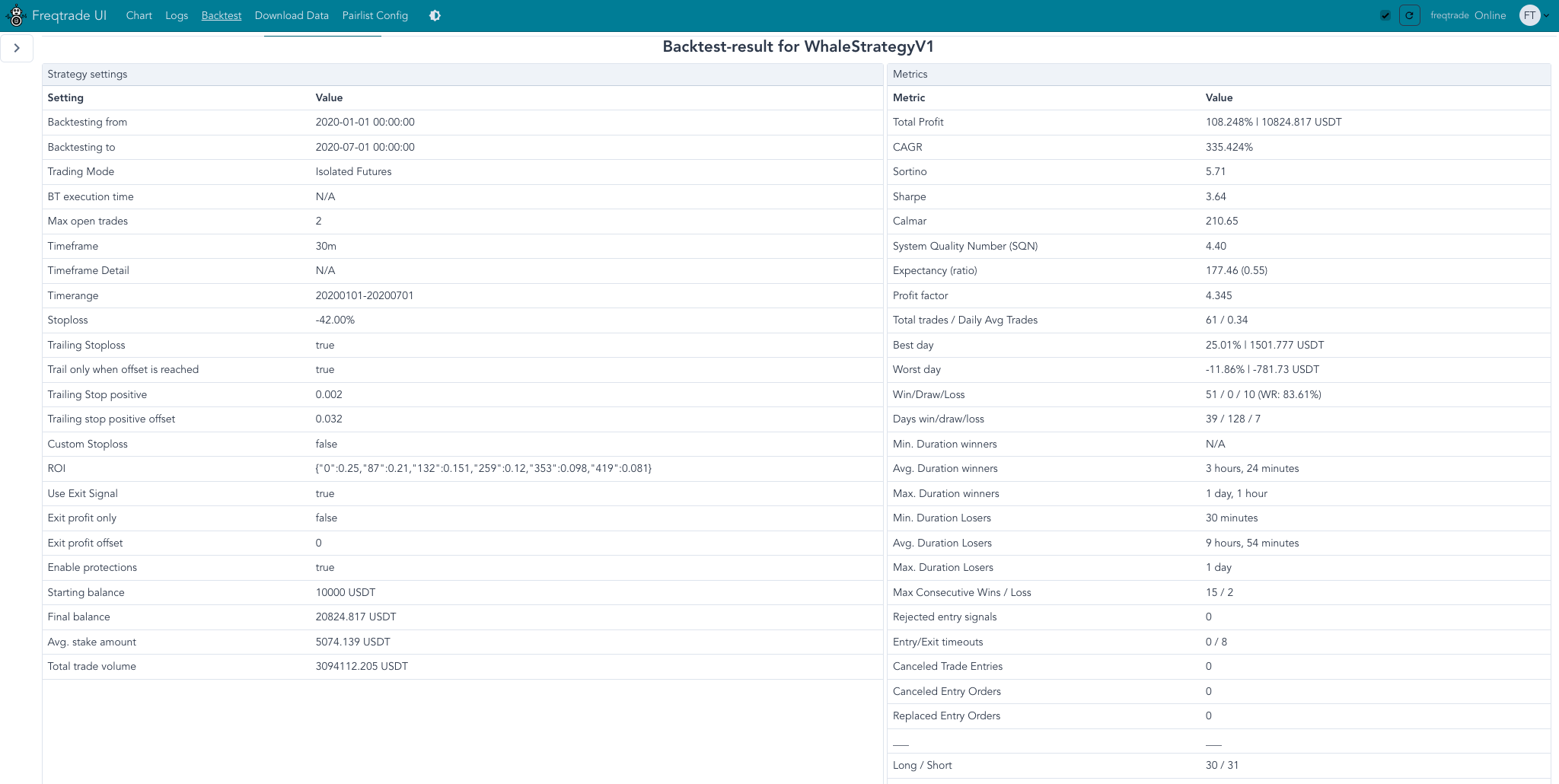

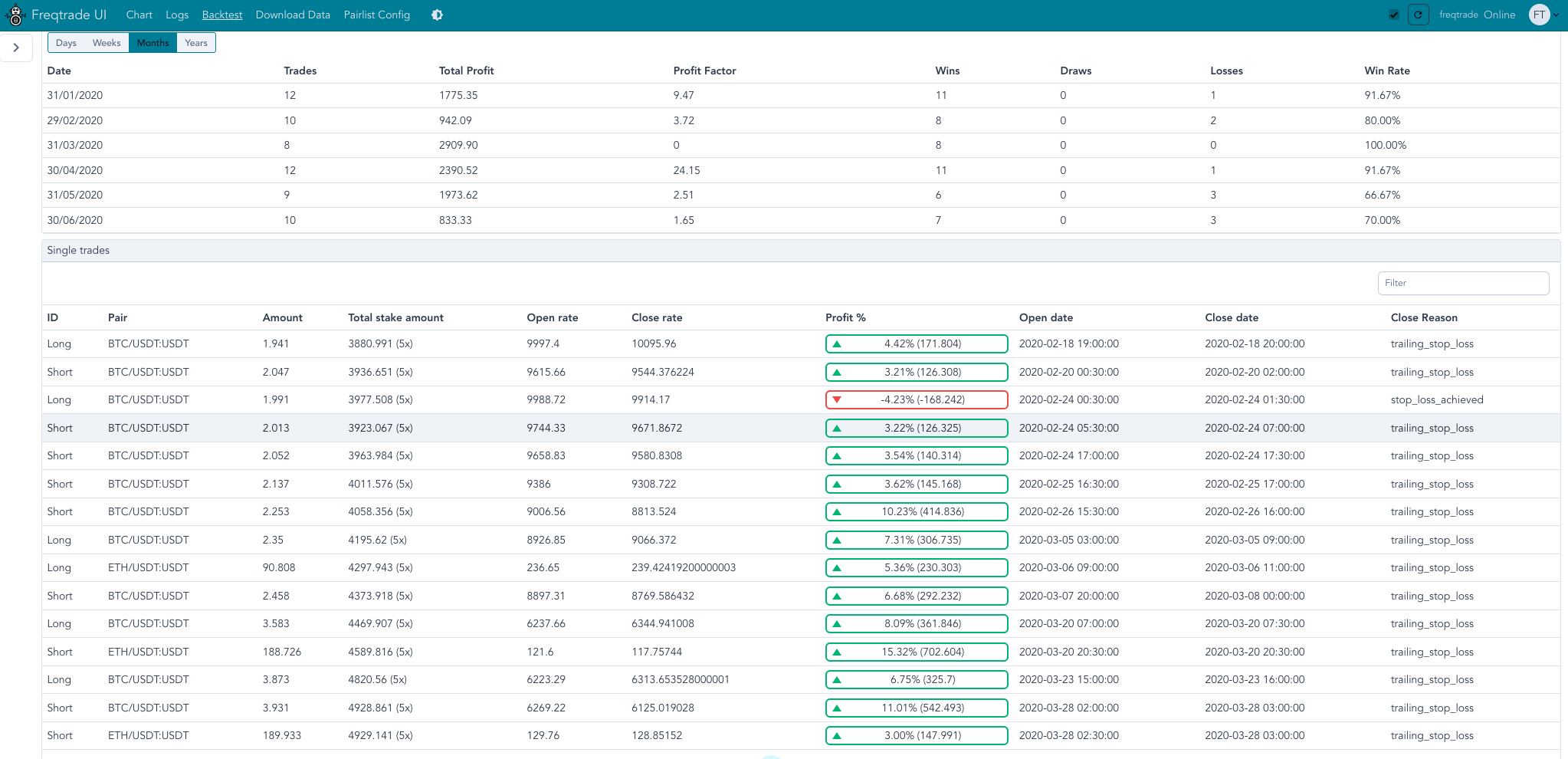

Backtest Report

The strategy was backtested using data from 2020-01-01 to 2025-07-01. View full reports here: Quarterly Report | Semi-Annual Report | Annual Report

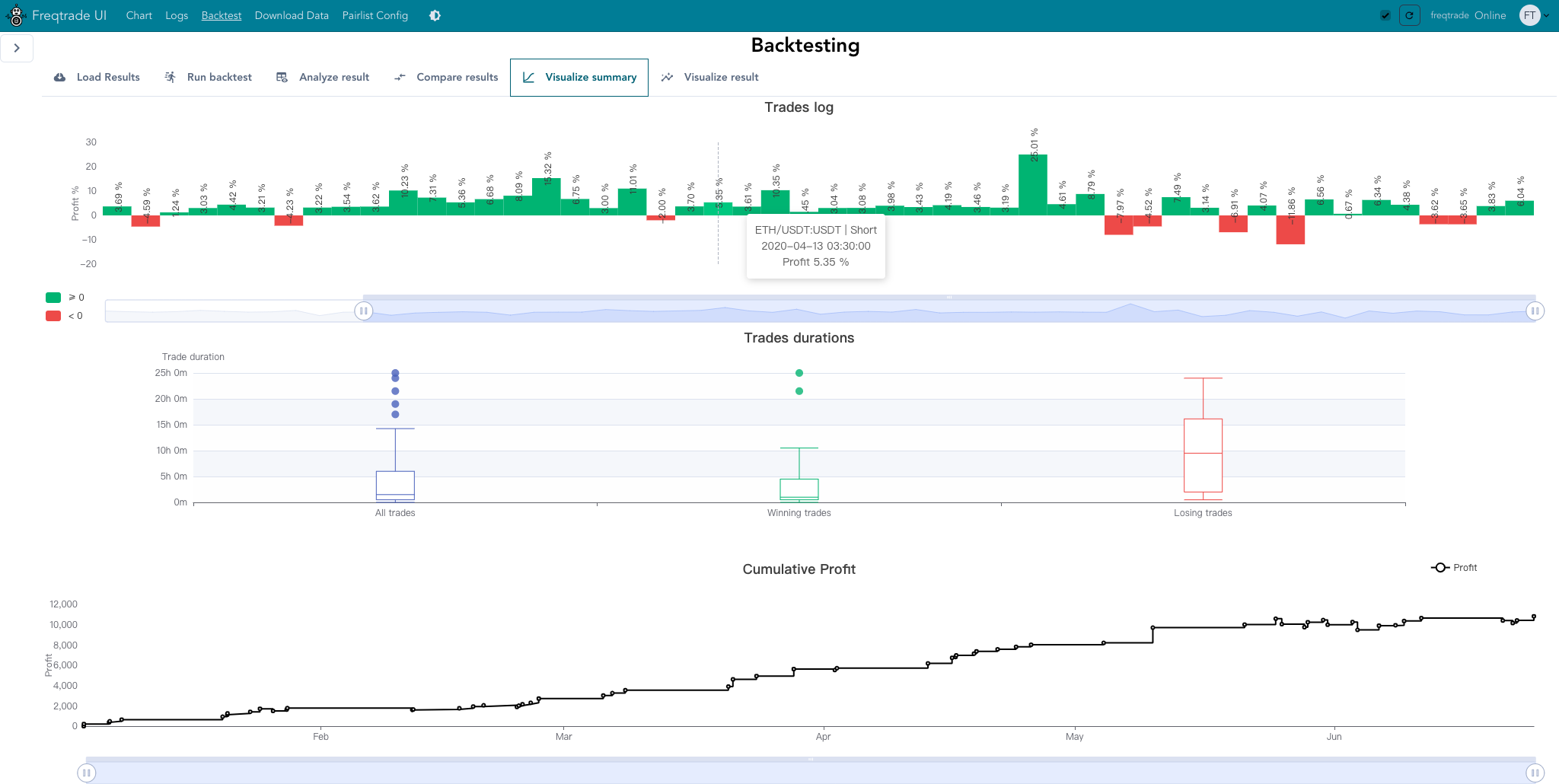

Backtest Charts

Quarterly Report

| Metric | Value |

|---|---|

| Total Trades | 2,038 |

| Total Return (%) | 1,422.36% |

| Total Profit (USDT) | 142,236.83 |

| Avg. Quarterly Return (%) | 64.65% |

| Avg. Quarterly Profit (USDT) | 6,465.31 |

| Avg. Win Rate (%) | 66.77% |

| Max Drawdown (%) | 47.70% |

Semi-Annual Report

| Metric | Value |

|---|---|

| Total Trades | 2,039 |

| Total Return (%) | 1,544.03% |

| Total Profit (USDT) | 154,403.11 |

| Avg. Semi-Annual Return (%) | 140.37% |

| Avg. Semi-Annual Profit (USDT) | 14,036.65 |

| Avg. Win Rate (%) | 66.80% |

| Max Drawdown (%) | 47.70% |

Annual Report

| Metric | Value |

|---|---|

| Total Trades | 2,075 |

| Total Return (%) | 2,843.71% |

| Total Profit (USDT) | 284,372.16 |

| Avg. Annual Return (%) | 473.95% |

| Avg. Annual Profit (USDT) | 47,395.36 |

| Avg. Win Rate (%) | 66.73% |

| Max Drawdown (%) | 47.70% |

🆚 Whale Strategy Source Code

支持其他平台?

本策略目前基于 Freqtrade 开发,但如果您希望在 TradingView(Pine Script)、股票交易平台(MetaTrader、Amibroker 等)、期货系统 上使用,可以通过以下方法轻松实现:

- ✅ 使用 AI 工具(推荐)

您可以使用 GPT 等大模型工具,将策略源码作为输入,提示 AI 将其转换为目标平台的策略语言。 - ✅ 适用场景

- TradingView(Pine Script) → 实现信号提醒和自动化交易

- MetaTrader(MQL4/MQL5) → 股票、外汇、期货自动交易

- Amibroker、NinjaTrader 等 → 技术分析和交易自动化

注意:

转换后请务必在目标平台进行 回测验证,确保逻辑一致。

策略常见问答(FAQ)

在那种行情下,敢问阁下是否爆仓?仓位能剩多少?

✅ 回撤高并不意味着策略不好,而是测试 足够真实且严格,没有弄虚作假。

不过,市场是动态的,实盘表现可能优于或劣于回测结果,用户需自行承担风险。

运行期间产生的任何收益或亏损,均由用户自行承担。

- 接受长期回测逻辑,而非短线暴利幻想

- 懂得风险管理,不满仓、不梭哈

我们建议 新手先低杠杆(1-2x)或现货运行,熟悉策略后再逐步调整。

这个策略的目标是 长期跑赢大盘,控制回撤,保持稳定增长,而不是追求一夜暴富。

📢 Final Summary

This strategy has been tested with real market data over an extended period, delivering high frequency, stability, controlled risk, and strong profitability. It’s ideal for small to medium capital quantitative traders, especially for short-term BTC/ETH trades. It also serves as a great reference case for crypto quant enthusiasts and strategy developers.

Keywords: Whale Strategy, Crypto Quant Strategy, BTC Quant, ETH Quant, Short-term Trading, Backtest, Automated Trading, Low Drawdown Strategy, High-Frequency Crypto Trading

✅ Do you want me to keep the humorous tone in the FAQ like your original Chinese version or keep it fully formal? ✅ Should I also generate an eye-catching title + tagline for this English version (like a marketing headline)?